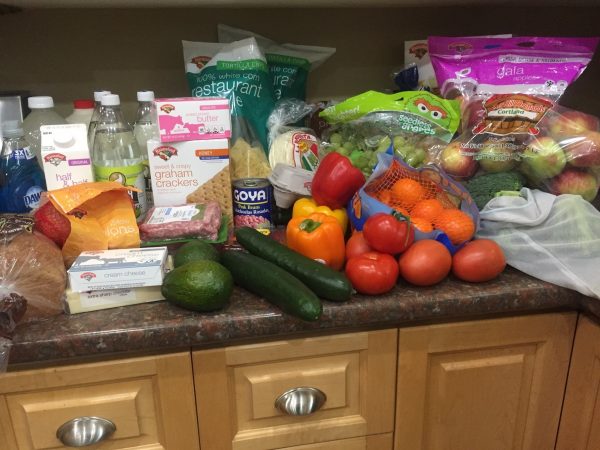

Since I’ve started working full time, I’ve almost exclusively used grocery services to buy my groceries. What are grocery services? There are several types.

Delivery Services

One type is a delivery service. Some companies, such as Instacart and Shipt, are companies that offer delivery from various stores in your area. You pick out your store, then pick out your groceries on an online app or website.

I’ve used Instacart extensively, in conjunction with Aldi. I really like it because it’s convenient and they bring food right to your door. But it’s not cheap.

These delivery companies generally make money in two ways: one, by charging a delivery fee (generally a fixed amount, like $3.99), a service fee (with Instacart, it’s 5% of your order), and a tip (this is also a recommended 5% of your order but it’s not required). On top of all these fees, the company marks up the cost of the food you buy. So if your potato chips normally cost $.89 per bag at Aldi, you’ll pay $.99 through Instacart.

Several times, the buyer has left the receipt in the bag, and I’ve been able to compare what he or she paid at the store with what Instacart charged me. The difference is usually about $25.

$25?! So why would I ever buy groceries from this service? That’s a lot of money!

What I’ve found is that by having a delivery service, I actually end up buying less than I normally do when I go into the grocery store. Because I’m not physically in the store, I’m not tempted to buy more than what’s on my list. Obviously if you’ve got great self-discipline at the store, this is not an issue you face, but for me, it’s helped.

Continue reading “Grocery Services: Are They Worth It?”