We’re well into June now, and the end of school is almost here. Our school year ends Wednesday, and then we’ll be spending entire days packing and getting ready for our big move to North Carolina. The weather in New Hampshire has been beautiful–cool mornings and warm days, with lots of sunshine. This time of year always has the power to hypnotize you with its beauty and leave you wondering why you were ever complaining about the weather.

On the home front, I’ve been finishing school work, packing, and doing graduate work (I have three courses more in my master’s program and I’m taking one in June and July). I’m so frayed that I’ve let all the non-important stuff go (you know, like dishes and laundry). Our house looks like we hosted a college frat party, minus all the empty bottles. We have all these random items in our corner, waiting for a yard sale, and there’s a dresser standing on its head in our entry, waiting for its Facebook buyer to come pick it up.

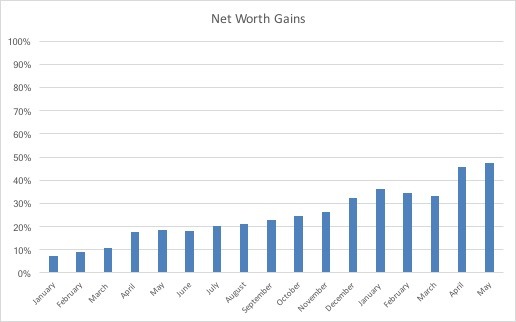

If you’re just joining, our family of four is on a three-year journey to double our net worth and become location independent. Each month, I record our progress on our net worth and our spending. Last year, we increased our net worth by 32% over the year before. This year, we’re trying to increase it by more than 65% from where we started in December 2016. Given the wild ride the market’s likely to take us on this year, I’m not sure it’s doable. But we’re going to try.

May showed us more steady growth. Much of our financial progress was on autopilot last month, as we found a buyer for our house and looked for places to live in our new town. We know that our net worth will take a big dip when we sell the house, so I’m enjoying these numbers while we can.

Our Progress

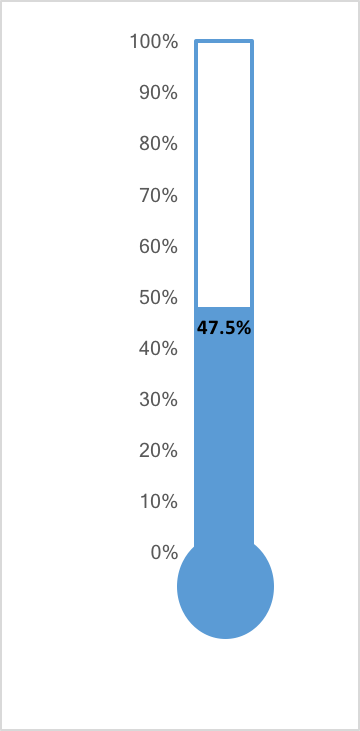

Even though we’ll officially be location independent this summer, we still haven’t doubled our net worth. So I’m going to keep reporting on that and our spending because I love goals. And I want to see if we can do it (I’m honestly feeling like there’s no way at this point).

As of May 31st, our net worth has increased by a total of 47.5% from our starting point in December of 2016. It would be so awesome if next month, the middle point of our three-and-a-half year journey, could show a 50% net worth increase. Unfortunately that will probably not happen because we’re selling our house, which is a very expensive proposition. So our net worth looks like it will drop quite a bit. It will be a one-step-forward, two-steps-back financial move for a while.

Here’s a graph to track our progress:

This is as a percentage of our total goal:

Spending Update

This month was a super-spendy one. We had moving expenses, travel expenses as we squeezed in a last trip to Montreal and a moving trip to NC to look for places to live. We had lots of unexpected “bonus” expenses this month like paying back our FSA almost $1000 and getting new brakes and pads (a surprise) and all-winter tires (not a surprise) for the Prius. Thank goodness we have savings.

We use YNAB (You Need a Budget) to track our spending and we love it. And we otherwise keep our spending and investing as simple as we can.

MAY SPENDING:

Housing: $1775. One fifteen-year mortgage payment. Taxes and insurance are not escrowed–we pay those twice a year.

Gas: $316.45. I think this was so high because we drove to Montreal and back and forth to the Boston airport.

Auto maintenance: $820.75. That is not a typo, unfortunately. The Prius needed new brakes and routers (about the only maintenance either car has needed since we bought them) and we had to buy new all-weather tires for the Prius as well.

Auto insurance: $0.

Home insurance: $0.

Groceries: $775.95. Despite a completely chaotic month, we still stayed close to budget. Here are all the details of our food buying.

Eating Out: $328.37. I promised to do better this month, but we did worse! $141.90 of this was when we went out with my friend to a really fancy restaurant. It was a wonderful experience but the rest of it was just buying stuff here and there because we were moving.

Household goods: $66.04. New cell phone chargers, a car magnet, and a replacement coffee cup.

Home maintenance: $278.46 Curbside composting and the cost to install a new water heater. Luckily, our old one was under warranty, so all we had to do was pay to have it installed. Just in time to move.

Entertainment: $218.47. The majority of this was taking the kids and my friend to a ballet production of Alice in Wonderland. My kids don’t see a lot of arts productions so I was glad to support this company. We also went to the Boston Science Museum, which was actually fairly inexpensive ($30 for the three of us with Library Passes). I tried to pack in some last experiences in New England since this would be our last chance to see them.

Kids’ expenses: $548.63. Two months of piano lesson checks cashed, after school program and school lunch (just gave up and had them eat lunch at school every day), and a Whoopee Cushion. Long story there.

Babysitter: $120. This was for when we went out to eat with my friend and when we went out at my sister’s house.

Mr. ThreeYear’s spending: $166.64. Lunches out at work. This category should drop dramatically this summer when we move and Mr. ThreeYear is working from home.

Mrs. ThreeYear’s spending: $33.98. I bought a Mad Fientist t-shirt, a coffee at Target, a coffee at Dunkin’, and a lunch at school. And some other random stuff. I don’t usually buy coffees on the road but I’ve just been hanging on this month, and I need more caffeine than usual.

Propane: $440.41. Last propane bill in this house. Woo hoo.

Other utilities: $252.24. electricity, internet.

Clothing: $108.96. Ok, this number should be $0 after last month‘s shop-a-thon, but I went to TJ Maxx and got some PJs and sunglasses, and our local thrift store for some summer clothes. And I got a ThreadUp box. That was just $10, though. They haven’t charged me for my purchases yet (I’ll have a post about that fun experience soon).

Medical: $986.41. We had a fun little surprise this month when we found out some of the FSA expenses we’d asked for reimbursement on were from last year so we had to pay that money back.

Moving Expenses: $699.61. Getting stuff fixed, propane maintenance, paint, etc.

Vacation: $533.48. Our costs from our trip to Montreal. We had budgeted $800 so I thought we did pretty good.

Haircare: $22.95. One haircut.

Fitness: $270.00. I’m really grouchy about this number because it represents cancellation costs for Mr. ThreeYear’s gym. He told me there were no cancellation costs but there were. My recommendation was to go month-to-month. Anyway.

Housekeeper: $60. Just once this month.

Subscriptions: $29. Netflix, Spotify, Skype.

Gifts: $195.42. Most of this was a wedding gift of cash we sent my niece in Chile. There was also a Mother’s Day gift in there (books!).

Total: $9047.22

Total without mortgage: $7272.22

I knew this month would be expensive and it was. While our expenses are higher than many in the personal finance community, we’ve still been able to pay off $38,000 in debt and build a high net worth in less than ten years. We started investing early, worked hard to increase our household income, and currently focus on keeping spending on the Big Three (housing, cars, and food) low. But we’re definitely imperfect and spend more than we could. So if that sounds like you, or you just want to laugh at how much money we waste, you’re in the right spot.

Happy End of School!

If you have kids or are a teacher, that is. We’re wrapping things up with the school year here and are beyond ready for school to be over.

See you next month, where I’ll be reporting from a new state!

Why is your net worth going to take a dip when you sell the house-the transaction costs? I also had to have brakes fixed on my car, but it cost about as much as your brakes + tires. Luckily last month was a three paycheck month for me, so I cash flowed it rather than taking money from my car repair fund.

Nice on cash flowing the brakes (but not the cost–bummer)! We did the same thing. Yes–the transaction costs for the realtor (6%) plus closing costs for the new house and moving costs add up to a significant amount, sadly. But, I’m hopeful we’ll save more in the new house and make that amount back quickly.

i love that last line about laughing about how much money we waste. i’m cracking up and in the right spot. that’s not bad for brakes and tires. the dishes and laundry are the 1st to take a hit. that would crush me to shell out about 20k for realtor and closing costs. i only want to move once more in this life, if that, but it’s cold and snowy here in the northeast. i know i don’t have to tell you that.

Always glad to provide a laugh, Freddy! 🙂 Yes, I’m having a hard time wrapping my mind around the costs too. Mentally I’m wrapped in a corner with my hands wrapped around me rocking back and forth. But it’s for a good cause! Are you guys headed down to Nola in a few years? That would be worth it IMHO…

i’m not sure yet about nola. we like visiting but i’m not sure if we want that into our old age. time will tell but i’m feeling like a renter of a place there maybe. did you read what i just wrote about the varying costs and responsibilities of dogs?

I can imagine it’s a lot of crazy down there. Read your dog post yesterday–great points about spending money on training. I’m the one that needs to be trained, honestly. And I can see it paying dividends in confidence like you pointed out.

Funny. I just wrote something about ‘surprise’ expenses too. Mine was a huge vet bill for my old pug and a new windshield for my car.

Detailing out the Mad Fientist purchase made me laugh a little. I was sad that I didn’t see he was doing t-shirts until they had already sold out!

Ugh, those are both hard. We’ve lived without vet bills for 8 years but our time’s coming. The boys (all 3) are slowly wearing me down about a dog. Ha! I was so excited to see the T-shirt in time. I got a MMM one too, so I’ve almost got my whole wardrobe for FinCon. 🙂

I would burn down that gym. $270.00 for NOT using their facilities? Ohhhh that is the biggest scam on this side of the equator. Burn down that gym Laurie!!!!

(OK I had some sugar…)

Your grocery bill looks so good! And eating out too! For so many boys!

Lily,

Argggghhhh. I just got mad again. I know, I know. It’s lack of competition (when we lived in Atlanta my gym cost $10 a month). And then they “accidentally” charged us $60 this month too. Which they will be promptly crediting back.

Thanks on the food. I feel like we’re learning. We are going to have an Aldi in NC–I think it’s one of the things I’m most excited about! I’m pretty sure our eating out bill will be going up, given all the new choices we’re going to be exploring, but I have a feeling our grocery bills will be going down. Choices. Selection. Competition. Lower prices. City living. I am getting excited!! 🙂